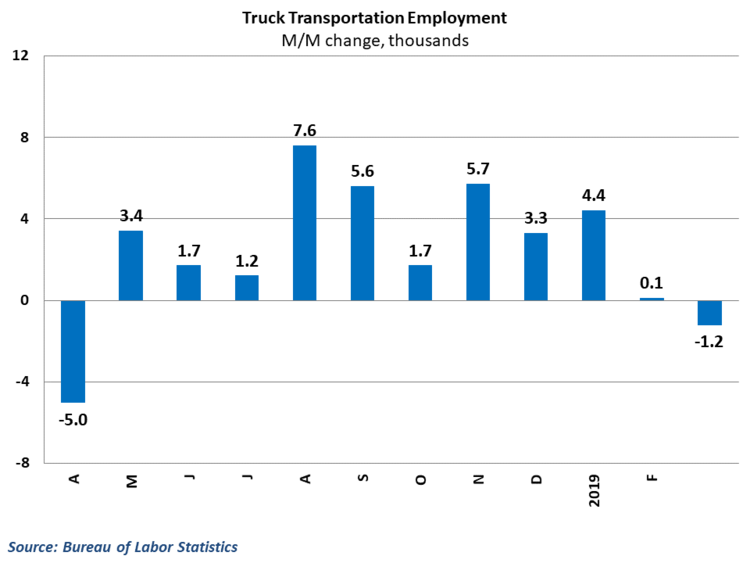

The year 2018 was a year that the trucking industry had never seen before and will more than likely never see again. While 2018 offered a look at an industry that was unable to fully make-up for the lack of capacity, 2019 is exhibiting the downturn so many expected with rising prices of freight along with last year’s capacity issues not being fully rectified. In 2018, there was an overwhelming shortage of new truckers, which hurt the overall capacity. However, in 2019, there hasn’t been a way to take full advantage of the increased capacity in the industry, leaving the new truckers without anything to do. This problematic flip of the switch has caused a downturn in the growth of the industry and left freight companies shipping truckloads that are not completely full.

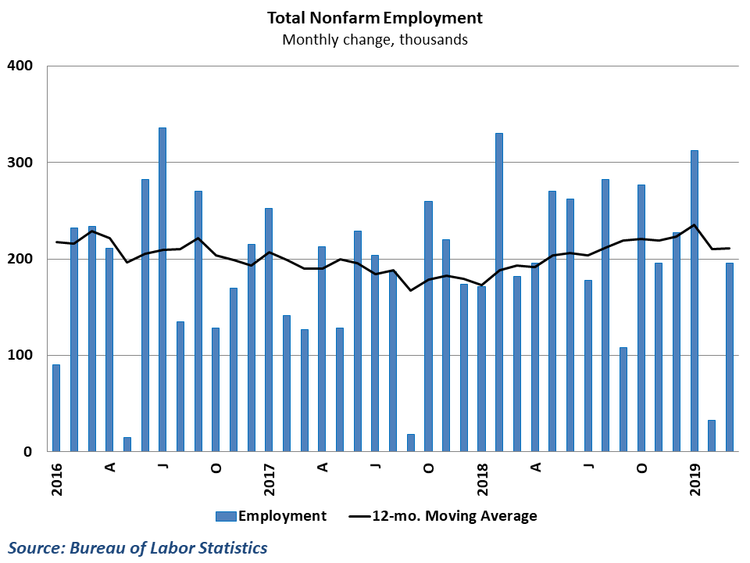

The Bureau of Labor and Statistics PPI shows that the growth that was so rampant and strong in 2018 took a massive downturn at the beginning of 2019, and hasn’t managed to bounce back. While bouncing back completely is not the expectation due to 2018’s growth being an outlier, the slide was not expected to be as drastic.

Along with suppressed growth, the industry also seems to have its inflation issues under control, which was looking to be an issue towards the end of 2018. As seen in the Bureau of Labor and Statistics numbers, the price inflation that has building for the last couple of years seems to have stabilized, returning the industry to less concerning numbers.

To read the original post, click here.